The Partnership Act of 1932 governs the registration of a partnership firm in India, which refers to two or more persons working together to complete a task. The Indian Partnership Act explains partnership as a relationship between people who have decided to share the earnings of a business carried out by all or anybody in India’s corporate structure. They represent everyone. There are no problematic business formalities to follow when forming a partnership. Read this blog to know about the partnership firm registration documents required.

Any firm’s progress is driven by its ability to make decisions. Because there is no concept of passing resolutions, decision-making in a partnership firm can be quick. In most circumstances, partners in a partnership firm have broad rights and can conduct transactions on behalf of the partnership firm without the agreement of the other partners.

According to the new Companies Act of 2013, the maximum number of members in a partnership firm cannot exceed 100. The prior Companies Act of 1956 set the maximum limit for banking and other enterprises in partnership at ten and twenty, respectively.

The registration of a partnership firm requires a minimum of two people. These entities must comply with the law differently than LLPs and corporations. Partnership registration is optional; it is up to the partners to decide whether or not to establish a partnership firm in India. However, because a partnership firm cannot obtain legal benefits until registered, it is always advisable.

Table of Contents

Partnership firm registration documents are:

When two or more persons come together to run a business, they sign a partnership deed. This contract outlines all essential business terms and conditions, such as profit and loss sharing, new partner admission, liabilities, required rules, exit method, and salary.

It can be used as a legal document in court if the company ends up in court. As a Partnership Deed, also known as a Partnership Agreement, is registered under the Indian Registration Act 1908, there is no possibility of it being destroyed while in the partners’ hands.

Furthermore, registering a Partnership Deed has numerous advantages, including making the firm eligible for a PAN, opening a bank account, and dealing with GST registration or an FSSAI licence .

The firm’s address evidence is required for partnership firm registration submission. If the registered office space is rented, the rental agreement must be submitted along with a utility statement such as an energy bill, water bill, telephone bill, property tax bill, gas receipt, etc.

In addition, a letter of authorisation from the owner will be submitted. The service charges shall be presented in the owner’s name if the nominated office is occupied. A NOC from the landlord is also required, as indicated in the service charge.

Regardless of the amount of profit or loss, the partnership firm also must file tax returns every year under the Income Tax Act of 1961. The partners of a partnership firm must obtain a PAN card to file income tax returns.

Additional documents are required for the enrollment of Association Firm to Partners to ensure the authenticity of all the information you provide in the form and the documents you submit. Partners must provide documentation of their organisation’s deed, identification, and address. In addition, an affidavit must be submitted, stating that all of the information in the deed and documentation is correct.

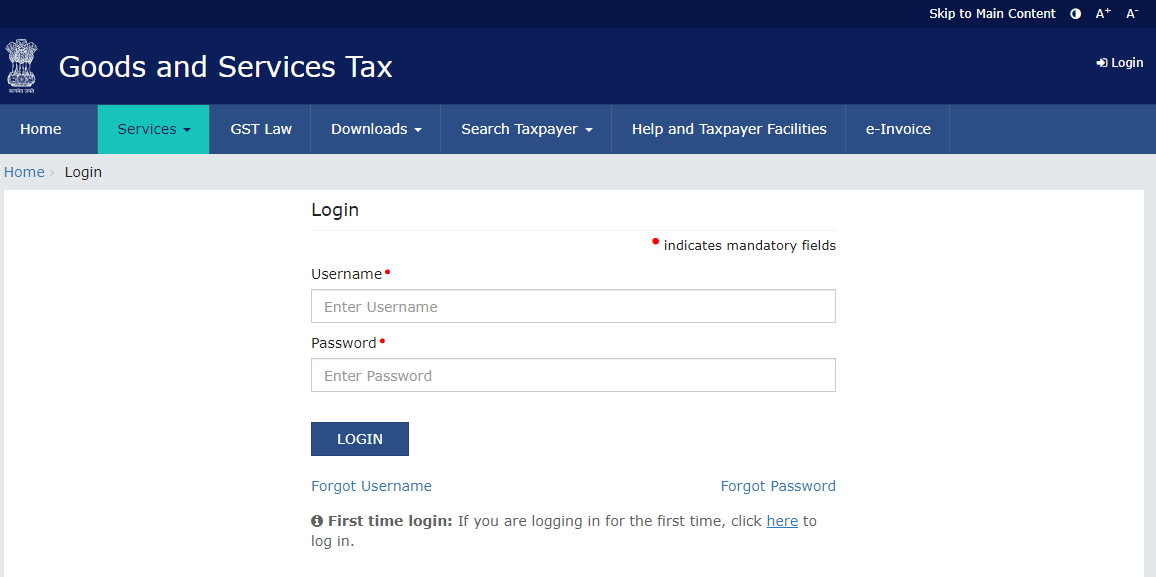

A firm must submit a PAN number, address proof, and a partner’s personality and address proofs to complete the GST registration process. The authorised signatory will either use a DSC Signature or e-Aadhaar verification to sign the application.

The following steps can be taken to register for GST:

PAN card, business address proof, Aadhar card, bank account data and cancelled cheque, candidate ID evidence, address verification and photograph, digital signature, and other documents are required to complete the GST registration.

Bottom Line

Due to its ease of establishment, a partnership firm in India is one of India’s most popular business or company formation forms. Only two partners are required, and many entrepreneurs choose to register their partnership firm online. However, it is critical for business owners to fully comprehend the requirements of each type of firm formation.

You have learned about documents required for partnership firm registration in India. Though registration may not be necessary if the partnership firm’s operations run well and there is good communication among the partners and outsiders. However, forming a partnership firm is always a good idea because the future is so unclear. Check our website at Vakilsearch for more information. We are a technology-driven platform that provides legal services to startups and established companies. Expert lawyers provide excellent guidance and support for your partnership firm and cover all legal requirements to set you free.

Read more: